One of Toyota's hidden cards, Vivopower, is planning to help decarbonize miners like the BHP Group.

- Feb 10, 2022

- 10 min read

Long-time proponent of hydrogen after developing the first commercial Fuel Cell car, the Mirai, Toyota has recently announced a slight shift in their approach by investing over USD $35 Billions until 2030 to develop Bev (Battery Electric vehicles).

We all know that the EV transition is well on its course and as we move further from fossil fuels, the transport industry's demand for sustainably-sourced battery metals is going to grow exponentially (demand is estimated to increase by factors of 18–20 for lithium, 17–19 for cobalt, 28–31 for nickel, and 15–20 for most other materials from 2020 to 2050).

Despite governments trying to stimulate investment in their own backyard and a solid support from the private market to fund exploration and exploitation projects, the mining industry landscape is slow to evolve as traditional proven methods are hard to replace with greener but possibly less affordable and established alternatives.

The paradigm of the carbon print behind the exploitation and refining of battery materials is an important argument against Bevs and to remedy it, a lot of investment and motivation is needed in fields like water treatment, soil regeneration, waste mangement and byproducts reuse, etc.

Another avenue to help decarbonize the mining industry is through the electrification and optimization of current mining equipment. For example, the eDumper is a prototype with a regenerative braking system that allegedly recaptures more than enough energy to refill the charge it used going up.

It is only since 2018 that the world's first fully electric mine was inaugurated in Ontario. As of now, multiples other projects are ongoing in Canada. Unsurprisingly, since the savings behind the transition are convincing enough to try to accelerate it.

For years, Glencore ran engineering analyses based on diesel but the result was always the same: there was too much overhead needed to power and build complex ventilation systems. But once the company began to consider using EVs, the math made it simple: 44 per cent savings for ventilation, 30 per cent savings for cooling equipment and a 44 per cent reduction in greenhouse gas emissions. In late 2017, the project was approved.

You may be wondering why this disruptive economic assessment isn't triggering and immediate revolution in the mining world. The truth is solutions are being sought to follow the strict ESG guidelines, and are being discussed on every serious board meeting.

So if economically, a diesel engine underground is costlier on many fronts, when can we expect current fleets to be converted to EVs?

The short and sweet answer is probably: "As soon as possible". The most complex one involves completing pilot projects and trials, designing, testing and redesigning prototypes, securing financing and supply chains, starting production and optimizing it. A rather difficult task for enterprises that are niches and mostly at the venture stage, you can also add to the mix a conservative OEM industry that somewhat doesn't seem prone to invest in RnD of new products without a pre-established market. This brings us back to probably the most used OEM of the mining industry when it comes to light-duty fleets. Allegedly, Toyota's Hilux and Landcruiser act as standards, and are two of the most if not the most used trucks in underground mines all around the world. So naturally, when mines are looking to transition from ICE to Bev they might be more prone to go with an already proven model instead of newly designed alternatives like the Bortana Ev from Safescape, or the R-series from Rokion.

With that being said, there will be room for multiples first movers as the sub-sector consolidate itself. But, what is Toyota planning to do with their investments in zero-emission vehicles?

"In pursuit of our battery development concept of achieving batteries that can be used with peace of mind, we will establish the needed technologies by conducting a certain amount of in-house production, and we will cooperate and collaborate with partners who understand and will put into practice our concept. We will also proceed with discussions with new partners in some regions.

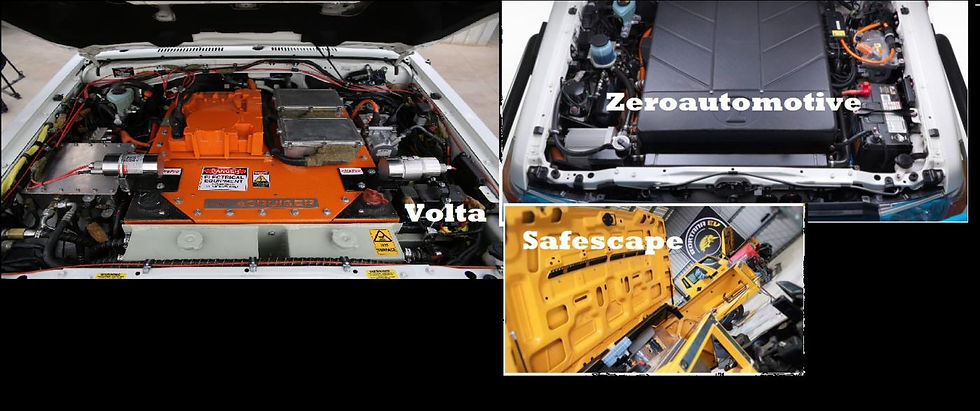

Some of these mentioned partners are tackling the electrification of Toyota's famous Landcruiser. They are: Vivopower's subunit: Tembo E-lv, Miller's Ev conversion Kit, Voltra's Ecruise, Zero automotive's Zed70 and finally Huber's Edrive.

Miller Technology, Australia.

Since September, Miller is piloting an inaugural project at the BHP Mitsubishi Alliance (BMA) coal mine in Queensland in collaboration with Tritium charging and BHP. No contracts or income statements have been publicly shared for now.

Huber, Germany

Huber Automotive AG is the core company of Huber group. The original group was founded in 1983 and the subunit that first specialized in electronics was founded in 2000. Their first retrofitting from diesel to EV was in 2011.

This new, optimised version of the Electric Cruiser follows several deployments in the underground mining field. According to Mathias Koch, Key Account Manager for Huber Automotive’s Hybrid & E-Drive division, units have been on duty since mid-2016 in German salt mines. The company has also sent vehicles to Chile, Canada, South Africa and Australia. Meanwhile, units to be delivered in the March quarter to Germany, Ireland and Canada are likely to benefit from the latest updates.

I asked a friend to translate their financial statements from German, and it seems that their revenue was roughly $30 millions in 2019, mostly by selling electronic component. Since then, in the last 2 years, they would’ve doubled their revenue with the EV-business. Their biggest customer, should be K+S AG (the previously mentioned salt mining company).

Voltra, Australia

Here you can read more about the origin of Voltra.

Founded in 2014 by two former Autoline employees, Voltra soon developed an electric model that got the attention of the mining industry. In 2018, BHP announced their commitment to trialing the eCruiser at their Olympic Dam mine site in South Australia.

There was no official further update that I could find since then.

Zero Automotive, Australia

Based at Edwardstown, South Australia, Zero Automotive’s offer a 78kwh model that has been modified to endure “hyper saline underground environment”. The EV and battery systems are from another Australian company, Sea electric. Zero Automotive has also formed a supply partnership with Toshiba.

After a first successful trial in 2020, with a Zero70 model, at the Carrapateena mine, with OZ Minerals, the company had a second trial at the same mine, with the improved Zero70 TI model, in March 2021.

Tembo, Australia

Founded in the Netherlands, VivoPower acquired 51% of Tembo on November 5, 2020 for €4.0 million. On February 2, 2021, the Company completed the acquisition of the remaining 49% of Tembo, for a consideration of $2.2 million and 15,793 shares in the Company. I will expand further about Tembo in the next section. But this is the recent public developments for the company.

LOI with Toyota for 5 years(+2 in options) in Australia.

$250m with GB autos for 7 years in Australia.

$120m with Access until 2026 in Canada.

$58m with Artic until 2026 in Scandinavia.

$30m with Bodiz until 2026 in Mongolia.

$215m over 5 years with GHH group.

I hope this small recap of the industry wasn't too heavy to assimilate because we are about to do a deeper dive into the subject of this article.

With so many competitors, why is Tembo a good bet?

We will expand on the reasons Tembo can be considered one of the most accomplished company converting Landcruisers, but first, let's take a short look at the company history. I will refer to the work of the Outback Travel Australia website's team. Please consider visiting their page.

In late 2017 we were made aware of the Dutch-designed Tembo 4×4 e-LV ‘Cruiser, then being distributed in Australia by Western Australian based automotive wholesaler, Autoline. This model was launched in Europe in July 2016.

The first model was developed in conjunction with Huber Group in Germany, but the latest development is with Actia in France.

In 2018, the company had its first trial in a mining environment, at the Boliden Tara Mine in Ireland. It also started to be distributed by Access in the Canadian Market.

In 2019, it started to be distributed by Artic Trucks in the Nordics countries, Bodiz in Mongolia, GB Autos in Australia and GHH Fahrzeuge in Germany, Turkey, Greece, Russia, India, the USA, Mexico, Chile, New Zealand, South Africa, Botswana, Mozambique, Namibia, Tanzania, Zambia, Zimbabwe, the CIS states and Latin America.

In 2020, CPS signed as an African distributor. Then, Vivopower acquired 51% of Tembo for USD $4.7 million. The rest of 49% will be acquired 4 months later in Early 2021 for USD $2.2 million and 15,793 shares.

In a future article, I will dig deeper into the distribution agreements that has been reached with their worldwide partners, the facility's expansion in the Netherlands and the GB autos recent acquisition, but for now for the sake of readability and to not take too much of your time, I will focus on the Toyota LOI and the possible trial Tembo might have with an Australian miner.

Toyota announced an LOI with Vivopower, but since then nothing?

In September 2021, Vivopower reached a big milestone towards being recognized as a reliable and well-designed Landcruiser EV alternative.

The binding LOI sets out the terms for the purchase of preliminary goods and services and the basis upon which a Master Services Agreement (MSA) is expected to be finalised to govern an electric vehicle conversion partnership between VivoPower and Toyota Australia. Final terms of the MSA are under negotiation, but upon completion, it is intended that VivoPower would become Toyota Australia’s exclusive partner for Landcruiser 70 electrification for a period of five years, with a further two-year option (seven years in total).

Edison's analyst, David Larkham said: “It is a real step change for VivoPower to move from re-kitting existing vehicles to being an integrated part of the manufacturing process,”.

This binding LOI is a precursor to a potential MSA (Master Services Agreement) which all parties are working towards at present.

It stated in the last Tembo update on October, 21.

During the second half of the financial year, Tembo accelerated the development of its 72kWh battery platform for the Landcruiser model in accordance with the highest automotive product development process standards, including but not limited to Advanced Product Quality Planning (APQP) and Product & Design Validation Plans (PVP & DVP) in close cooperation with GB Auto and Toyota Motor Corporation Australia Limited (“Toyota Australia”). In recent months, Tembo’s team of engineers have collectively developed an enhanced product, which is undergoing extensive testing and at the same time as the first customer prototype vehicles for this enhanced product are being assembled in Australia.

Fair to say that Tembo is still in this APQP process with Toyota, If they were to sign an MSA it should be by the time they start production, we could then maybe aspire to see the market start to price Tembo's on forward earnings.

In early February, Toyota Australia announced the inauguration of the All-New center for excellence, in their promotional video they mention conversion vehicles at the 1:11 minute mark. (Please watch the video)

In this video, you can also see this vehicle appear in a few frames.

Notice these orange parts fitting the Tembo's model in the following pictures. The orange parts should be the rear-box battery pack. This is from GB auto's website.

This picture of another Tembo model is available on the GHH website and shows similar orange parts.

This comes from Tembo's website.

The similarities seem too numerous to be a coincidence, we could assume with a reasonable doubt that the new Toyota's facility is currently giving a good opportunity to Tembo as their vehicles are already on the floor possibly ongoing tests and possibly starting what could be a small production line. To note that Ray Munday, Management, said that they were going to do conversions on place.

So as we are waiting on Toyota on the production front, the second question that comes to mind is, did Tembo secure a trial with a mine since their first trial in 2018 at the Boliden Tara Mine in Ireland?

Toyota, Tembo and BHP, a trifecta?

BHP Group’s commitment to reach net-zero emissions before 2050 as pushed them to be an active company when it comes to pilot projects with EVs. As previously mentioned, they had a trial with Miller in a coal mine and Voltra at the Olympic Dam site.

They also recently announced a deal with Toyota to supply them with Nickel for their battery plants. Previously, on January 7, 2021, they also announced a partnership with Toyota for a light EV trial at BHP’s Nickel West operations.

Eddy Haegel, Asset President, Nickel West, BHP said:

“The battery in the Toyota EV Landcruiser also contains a high proportion of nickel. With Nickel West being both a battery raw material producer and consumer in the electric vehicle market, it is a terrific opportunity to support Toyota with their understanding and development of electric vehicles for the mining industry, whilst also reducing the carbon footprint from our own nickel operations.”

Tembo batteries are using a Nickel Heavy formula for their batteries, learn more about the differences between NMC and LFP lithium-ion batteries.

The Olympic Dam trial involves probably Tritium Charging and Miller Technologies.

With this news they also relased some pictures, Please take a closer look at the orange rear-box and the stickers close to the charger plug.

Again awfully similar to these right? There is good chances for Tembo to be the unannonced company procuring EVs to the Nickel West project.

In conclusion

It's after a lot of effort and observations from a few shareholders in the Vivopower's unnoficial discord group, especially Jackie Cheon, that we came to establish a relationship between Vivopower, Toyota and BHP. We put together a lot of evidence to support this case, and we can conclude beyond a reasonable doubt, that Tembo might be having a trial in BHP's Nickel West operations and cars sitting in the brand new Toyota facility. These observations gives us arguments for Tembo against their competitors as they are the only ones with an official binding Letter Of Intention (LOI) with Toyota and also a global distribution network with hundreds of millions of dollar in agreements on a global scale. For more DD, please visit my website and subscribe for free, you can also join the discord and the subreddit. I'm also lurking on twitter.

If I'm missing something please don't be afraid to comment and try my other articles about Vivopower.

And obviously, before leaving I will compare Tembo's charging plugs and battery packs with their competitors.

Motors

Miller technologies Huber Automotive

Rear-end view.

Charging plugs

Voltra has a similar orange box but not a similar plug, Huber has similar plugs but no orange boxes same goes for Zero Automotive.

Disclaimer: We are long $VVPR, not investment advice, not a registered professional. You could lose everything, buy at your own risks.

2021-08-06 Burlap's Gambles

Author: Burlap

Comments